By Neil de Beger

Neil de Beger is a Senior Marketing Leader with over 25 years of experience across Financial Services, Automotive, Technology & Telecommunications, and Retail. Neil has expertise in strategy and implementation across all marketing channels, with global blue-chip brands and local companies, both in-house and within specialised marketing and advertising agencies in Australia and the UK.

Financial technology, or ‘Fintech’, has recovered from a 2022 global correction and is poised for a return to its powerful growth trajectory.

Fintech’s recovery is part of a longer-term growth trend that Boston Consulting Group (BCG) recently described as having ’exploded’ in the past two decades globally, with anticipated massive (six-fold) growth over the next seven years. Fintech should account for some 25 per cent of all banking valuations worldwide in that time and represent a market-worth $1.5 trillion based on annual revenues.

The BCG report Global Fintech 2023: Reimagining the Future of Finance says the largest growth markets globally will be in the Asia Pacific.

Which is good news for Australian Fintech entrepreneurs, including those players in the digital advice space. Australia’s wealth market has attracted renewed interest from various Fintech companies, as the wealth and financial advice sector seeks new ways to help meet the unmet and complex demands of an ageing population requiring increasingly more urgent financial advice.

Start-up energy, planned focus

In the dynamic realm of start-ups and an ever-evolving business landscape, no two days are alike. Whether you find yourself in the early stages of your start-up journey or experiencing rapid growth to meet market demands, one thing remains constant: the need for a solid marketing plan.

In many larger organisations and corporates, it’s common for employees to operate in siloed functions. In a start-up environment and especially within the Fintech space, this isn’t necessarily the case.

Many may find that in addition to operating within their own specialist area of expertise, they are also a ‘Jack of many trades’. You could be having a sit-down (trying to!) with your colleagues to plan the week one minute, whereas the next, you’ll be picking up the phone to an intermediary customer and their client – and they need some help to run a report, right now!

The early stages of a start-up are fast-paced and can be thrilling. It changes at warp speed and comes with many challenges, just as it does the opportunities.

So, you might ask yourself how you’re supposed to do your job efficiently and does working in a Fintech also mean that you need to change your marketing approach?

It might! For a start, the ability to be agile and adaptable to moving operational priorities is a must.

A dynamic approach

Being involved in the very early stages of a start-up means exposure to areas of a business that you wouldn’t necessarily have, within a larger organisation.

You must embrace that everyone is on the same level playing field, ready to roll up their sleeves to get the job done. You have to ‘muck-in’.

For a marketer, it exposes you to the coalface – you gain invaluable access to the customer and on a frequent basis, which is like holding a winning ticket.

It’s a dynamic and fluid environment but the fundamental approach to marketing does not change.

If you take a strategic approach and keep the customer at the core of your plan, you are much more likely to succeed.

Strategic Approach: Maximising Returns

A well-designed marketing plan is indispensable in keeping a team focused. In a start-up, it serves as the glue that binds strategy and execution. You should use it as a constant source of guidance.

The planning process is critical. Begin by conducting your market analysis and research. A skilled marketer understands that they are not the customer and seeks to understand their audience. In a Fintech, this can be as simple as engaging in conversations with potential customers or, even better, visiting their work environment to validate your MVP (Minimum Viable Product).

Gaining these insights and comprehending the market, will help you to identify the key segments and your target audience and help you to firm up your positioning, to each one.

Based on my experience, having one or two other companies offering similar services, solutions, or products can be beneficial for a fintech. Often, the market is substantial enough to accommodate multiple players and among other things, it reassures you that you are on to something!

What truly matters is that you have a distinct and well-defined positioning. It’s essential to have clarity from the outset, so that customers understand why they should choose you.

Mapping the Customer Touchpoints: Optimising Marketing Effectiveness

A comprehensive marketing plan that has undergone the afore-mentioned process is more likely to succeed, and customer experience plays a crucial role in achieving this.

To maximise effectiveness and measurability, it is essential to have a laser-like focus on your target segments and determine which tactics within your marketing mix are feasible.

Having tangible measures is vital for determining the impact on the bottom line and identifying the areas where you see the highest returns, enabling you to provide accurate reports.

One advantage of working in a start-up environment is also the dynamic culture, with minimal bureaucratic hurdles. This agility allows for quick adaptation and execution since it also involves working closely together.

For the Fintech customer, interaction with the product or service is often necessary before they make a purchase. This can take the form of free trials, product demos, training sessions, webinars etc. So, a philosophy of continuous testing, measuring, and optimising the mix is required.

Close collaboration with colleagues in Sales and Operations (and often, strong camaraderie) is essential to helping map out the different steps, stages, and touchpoints, from lead capture and marketing activities to interactions extending past initial sale.

The process doesn’t even have to be overly complicated initially either; you can add to it as you go. It provides a clear picture of what works and what doesn’t, which activities have greatest contribution to the sales, what is most effective for converting leads, and it helps identify areas for improvement.

Punching above your weight (and market share!)

So where do you start? As with any new Fintech start-up, you’ll almost certainly need to build your brand. You won’t have the luxury of being able to run large-scale mass-marketing campaigns. So you’ll need to be as targeted with spend as possible. You may even need to back yourself with some innovative and creative thinking to cut through.

You will need to build credibility and trust. Especially true for a Fintech, where customers need to be able to trust your product, or software.

It also means that you need to aim high and punch well above your weight with your marketing!

Proven Strategies and Tactics for Marketing and Communications

Once your segments have been locked in, it’s time to firm-up the marketing and communications strategy. Good marketers define clear, measurable objectives, before launching into tactics.

If you have a budget, it will most likely be lean (certainly not as large as a corporate budget), which requires extra conscientiousness, especially of your investors’ money.

To achieve long-term success, it is crucial to adopt a holistic marketing and communications plan rather than solely focusing on short-term tactics.

Les Binet and Peter Field’s renowned paper, “The Long and the Short of It,” challenged the notion that effective advertising requires a blend of rational and emotional elements. Their research revealed that pure emotion is more effective in the long run. This aligns with my own experience.

However, it is still important to generate sales, which are the lifeblood of any growing Fintech business if you want to sustain operations and secure further investor capital.

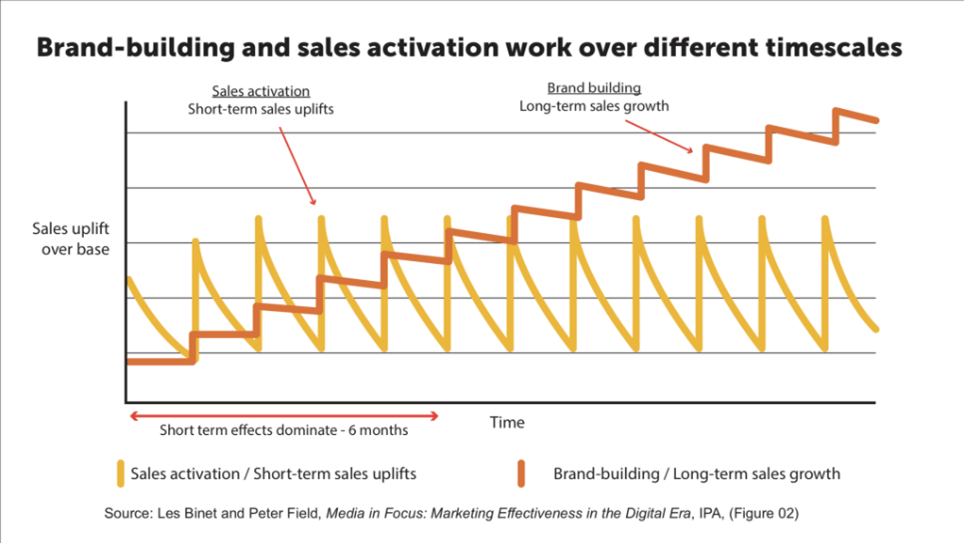

In financial terms, “activation” refers to an immediate response and ideally an immediate sale. On the other hand, “brand building” aims to establish a steady flow of sales, revenue, and profit in the present and future. Striking the right balance between the two is critical, for any Fintech.

It is worth noting that brand building is not limited to the long term. An effective advertising or marketing campaign with a long-term focus will also yield positive short-term results.

As a general guideline, Binet and Field suggest allocating approximately 60% to brand building and 40% to activation.

Businesses that under-spend or fail to strike the right balance may experience repercussions in the span of two or three years, even if they manage to get by initially.

A strong brand trajectory over time will also naturally attract more people to seek you out, reducing the reliance on paid channels for customer acquisition.

Public Relations (PR) in the Fintech Industry

PR is an incredibly effective channel for enhancing brand awareness and engagement in both the short and long term for any start-up. A well-crafted press release, coupled with strong media relationships, can yield impressive results.

Traditionally, the success of a press release has been evaluated based on media coverage and reach, including mentions on social media – all valid “soft” measures. However, by leveraging tools like Google Analytics, you can significantly enhance this measurement. A good starting point is to analyse the sources of your website traffic. Establishing benchmarks or average performance by channel allows you to gauge success more accurately. For instance, you may notice a significant increase in direct searches for your brand following the press release and subsequent media.

Further, you may observe a surge in community engagement on social media platforms, with more followers and increased interaction on your LinkedIn page.

To amplify the cumulative impact across various mediums, consider running a targeted paid LinkedIn campaign alongside the press release launch, where you promote thought-leadership.

By integrating expertly crafted content derived from a broader communications strategy, such as a free e-Book addressing specific customer needs, you can align with your core positioning and key messages and effectively reach and attract potential customers. This is where an integrated communications strategy truly takes shape.

Aside from website traffic, the number of leads captured during this period through your website can provide further insights into the effectiveness of your PR efforts.

However, it’s crucial to proceed with caution to ensure proper setup for accurate measurement. Engaging in too many activities simultaneously can make it challenging to attribute results accurately. Nevertheless, with a well-planned touchpoint mapping, you will swiftly gain insights into tangible measurements and the actual impact of the press release, on the bottom line.

The importance of a comprehensive and measurable communications strategy

PR and communications strategy, although related, have distinct differences – the previous points shed light on this fact. In the realm of business and marketing, PR primarily focuses on managing and shaping perception and reputation through tools like press releases. However, solely relying on a press release wouldn’t have yielded the same impact as a comprehensive and long-term strategy.

A holistic comms strategy delves deeper and encompasses a wider range of activities. Its purpose is to effectively communicate with diverse audiences based on a derived strategy, spanning the long term. While PR activities concentrate on creating positive perceptions, generating publicity, and handling crises, a communications strategy operates within a broader framework. It encompasses all facets of an organisation’s communication endeavours, entailing the development and execution of a thorough, strategic plan.

A communications strategy considers the organisation’s objectives, target audience, relevant key messages aligned with the segmentation strategy, appropriate channels, and desired outcomes. It outlines how a business or organisation will consistently and cohesively communicate its mission, values, products, or services.

Solid communications strategies often incorporate PR activities, along with other forms of communication such as marketing comms, internal comms, crisis comms, and digital comms.

In essence, PR serves as a specific component within a broader communications strategy, and when utilised together, it can significantly contribute to both short and long-term growth.

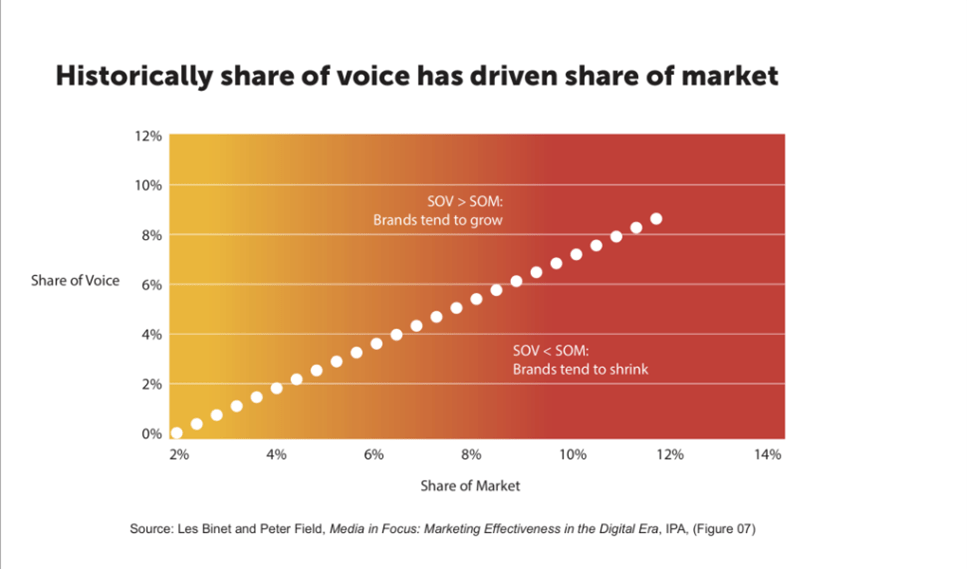

Binet and Field also determined, the greater the Share of Voice (SOV) the greater the Share of Market (SOM).

Choosing the right communications partner

If your team lacks the capacity, resources, or expertise to handle your communications strategy internally, seeking external assistance from a business partner or agency is your best option. Communications strategy is a specialised skill that plays a crucial role in your overall internal and external marketing ecosystem, so it’s important to execute it well.

Regardless of whether you choose an individual with strong skills or a smaller boutique agency, certain fundamentals should be a priority for your chosen partner. They must possess excellent communication skills and share your long-term vision for the business. These skills and the services they offer, must also match what you are trying to achieve with your marketing.

As a start-up or growing Fintech, you may not require all the bells and whistles offered by a large agency with lots of clients, promised efficiencies and a multitude of available resources. In fact, you might benefit more from a partner who operates in close collaboration with you and takes a personalised approach. Consider partnering with a smaller boutique PR and Communications strategist or agency.

For instance, if you are sending out press-releases, do you have the necessary skill-set in-house, to be able to handle media enquiries, train key spokesperson on how to accommodate journalist interviews or, would you be better off seeking expert media training?

Of course, your chosen partner should be capable of executing various public relations strategies, possess exceptional writing abilities, and ideally, have strong media connections themselves.

However, a partner with proven credentials in your specific market, deeply understanding its nuances and your target customers, is more likely to be fully engaged with your business success, rather than treating you as one among many potentially larger clients.

In my experience, even if you initially require only specific elements of execution, a specialist comms expert or an agency that offers more of a boutique approach, will be highly receptive to assisting you in assembling these pieces to maximise your returns and impact. You might only start with a press release and a couple of thought-leadership pieces, yet specialists in communications are the ones who can help you to achieve optimal exposure to your target audiences.

An invaluable partner is one who truly comprehends your business and shares your excitement about its technology and growth potential. Remember, they should be the catalyst for generating outstanding PR traction, not the other way around!

Conclusion

In the world of Fintech and start-ups, successful marketing hinges on key principles. Understanding your customers and target audience, along with a compelling positioning strategy, take precedence over immediate tactics. Getting these fundamentals right significantly boosts your chances of success.

Effective marketing in Fintech requires a shared goal and robust internal collaboration. It thrives in an environment of continuous testing, measuring, and optimising. Seize the advantage of being close to your customers and actively seek their feedback to fuel ongoing improvement.

When venturing into the realm of Fintech, building your brand becomes a necessity. Gaining credibility and trust are paramount, especially when entering a competitive market. It demands going above and beyond expectations, despite being a newcomer.

Crafting a strategic marketing plan is indispensable. Moreover, aligning it with a comprehensive communications strategy ensures a cohesive and streamlined approach, to achieving your objectives.

When selecting a communications partner to collaborate with your team, thorough evaluation is crucial. Look beyond surface-level attributes and find a partner who is truly committed to your growth journey. Seek personalised service that aligns seamlessly with your own marketing and expansion plans.