Coffee with… Wouter Klijn, Director of Content, i3 Insights

By

Wouter Klijn is a veteran of the institutional investor space in Australia, having spent much of his 20-year editorial career working for specialist media titles including Investor Weekly and The Insto Report. We sat down to get his views on the financial services industry’s shift away from product, the positive impact of tech on journalism […]

Hayne’s 76-point vintage uncorks a beginning, not an end

By

After a year of testimony drawn from 130 witnesses, made over seven public hearings, based on 10,000 submissions, the Hayne Royal Commission into Misconduct in Banking and Financial Services ended on Monday with a resoundingly modest point score just shy of 80. That is the total number of key recommendations – 76 – that will […]

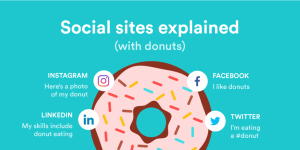

How to use social media if you donut know

By

One of the most common questions asked of us by clients is: what do we do about our social media? Unlike comms industry colleagues working with luxury brands, or fast-moving consumer goods, the highly-regulated world of financial services offers fewer opportunities to get creative with your socials. Yes, everyone loves a well-constructed and genuinely original […]

There’s an art to being stuck in the middle

By

As a PR consultant, sometimes we get caught between what the journalist wants and what the client wants. Unfortunately, their two needs aren’t always the same. Enter the middle woman/ man. Your role is essentially to manage the process of lifting the media presence of your clients whilst also providing your network of journalists with […]

Lunch with… Jason Spits, Senior Journalist, Risk Info

By

One of the financial services industry’s most respected trade journalists, Jason has worked in finance media and communications for around 20 years, including roles with Money Management and the Financial Planning Association. We sat down to get his take on the impact of the Royal Commission, how technology will play into funds management and life […]

Making the switch from journalist to the PR person journalists don’t hate

By

As published in Mumbrella: After deciding to make the switch to PR, Sarah Kendell promised herself she wouldn’t become one of the PRs she used to hate. Here, she details exactly how she did it. Earlier this year, I made the move from journalism to PR, which was both an exciting and daunting prospect. […]

Defining our MAX factor in an issues-rich world

By

Our growing business is in the running as a finalist for ‘Public Relations Company of the Year.’ How good is that? It’s a significant honour for our passionate team of consultants, and especially poignant given the current enormous public focus on the reputation of banks and providers to the wealth sector. The sector needs good […]

Beyond the “Terrible truths” “Haemorrhages” and “Scandals”: what now for the reputation of the wealth sector?

By

Details emanating from the past fortnight of the Adele Ferguson-instigated banking Royal Commission had the nation’s headline writers and cartoonists stretched to keep pace with an extraordinary run of revelation, confession and a collapsed witness hauled off to hospital by ambulance. They had much to work with. With the indomitable Justice Hayne methodically logging reams […]

Madden continues expansion with latest recruit

By

Specialist communications counsel Madden & Assoc. (Madden) continues its growth ascension with Amy Boyce joining the firm in the role of Account Manager, effective immediately. Her addition to the Madden team highlights the expansion opportunities across the financial services sector and diversification into consumer-led corporate and financial campaigns for the future. Madden founder Bruce Madden […]

Financial Media Services Rebrands to Madden & Assoc.

By

Specialist communications counsel Financial Media Services (FMS) has announced it has rebranded to Madden & Assoc. (M&A). The new brand reflects the company’s deep financial sector heritage and points to an expanded future for bespoke communications advice to consumer, fintech and digital clients. M&A currently services leading ASX-listed and private brands within the financial services, […]

Judges, pigs and lip gloss. A modern day reputational conundrum

By

One of the least surprising revelations to come out of last week’s Turnbull Government announcement regarding a Royal Commission inquiry into the banking sector was the fact that the big four banks had requested it. There was no other choice but to support a Royal Commission. Clear the decks. Lance the reputational abscess and, in […]